Astrea 7 bond

AZALEA Asset Management an indirect subsidiary of Temasek Holdings is launching a new series of bonds back by 38 private equity PE funds. 11 Years 7 Months.

10 Powerful Misfit Of Demon King Academy Quotes Qta Demon King Misfits Demon

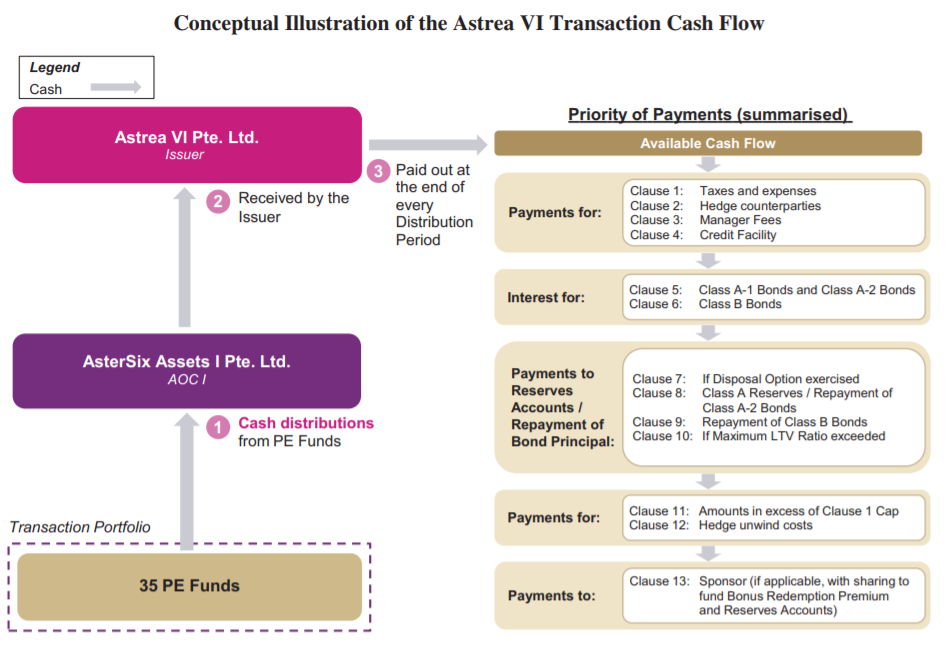

Astrea VI bonds are issued by Astrea VI Pte.

. The size of the transaction is about 755mn or S105bn 396 of its underlying PE portfolio valued at 19bn. You may be surprised about what you read. Blanket Bail Bonds LLC is a New Jersey Domestic Limited-Liability Company filed On October 1 2010.

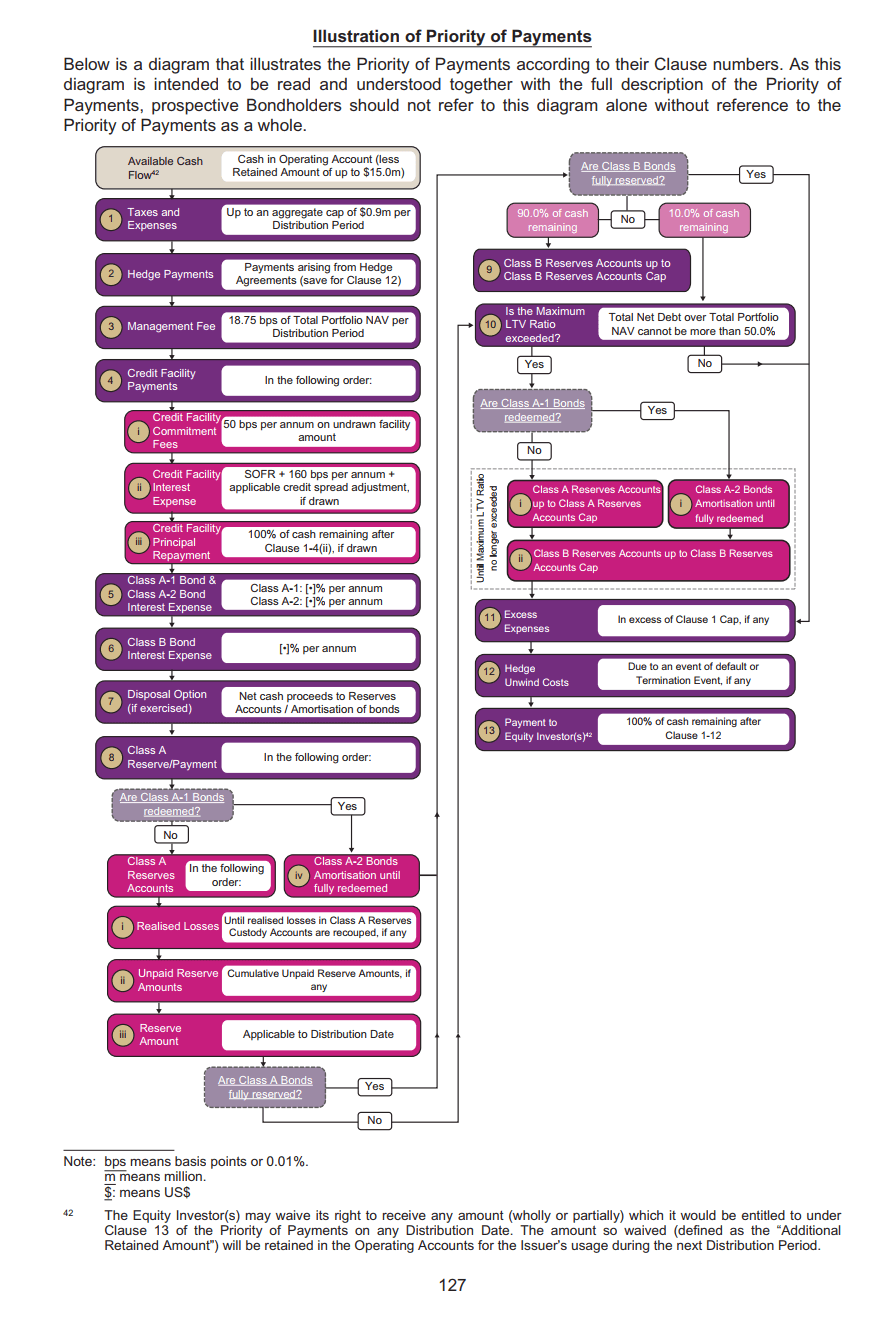

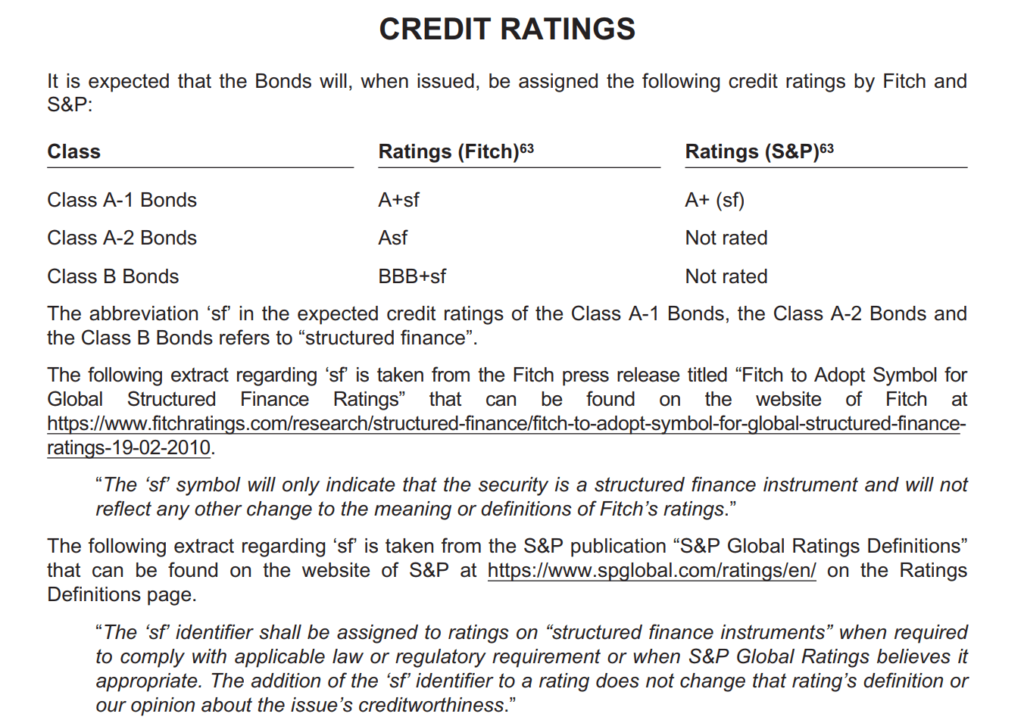

The issuance is expected to have three classes of bonds namely A-1 A-2 and B but only Class A-1 and Class B bonds will be made available to retail. Astrea 7 PE Bond investors face typical risks such as default interest rate liquidity inflation risks exchange rate risks adverse macro-economic or market conditions including those arising from rising inflation andor interest rates armed conflicts or a pandemic and other risks specific to private equity investments such as. Class A-1 Bonds offering 4125 per annum and Class B.

It is around 396 per cent of the underlying PE portfolio valued at US19 billion. It is offering 277 million of Class A-1 Bonds and US100 million 138 million of Class B Bonds to retail investors in Singapore. Jfk Hartwyck at Edison.

Application will close on 25 May. The bonds received orders over 11bn 17x issue size. Astrea 7 offers three classes of bonds.

The initial price guidance for Class A-1 A-2 and B bonds are 4375 5625 and 6375 respectively but are also subject to change. The resizing of tranches resulted in slightly more negative cash flow modelling results for the A-1 bonds due to the higher LTV but did not materially change Fitchs overall analysis which supported todays affirmation of the. The reallocation of class A bond principal did not result in a change to the cumulative LTV of Astrea 7s rated bonds.

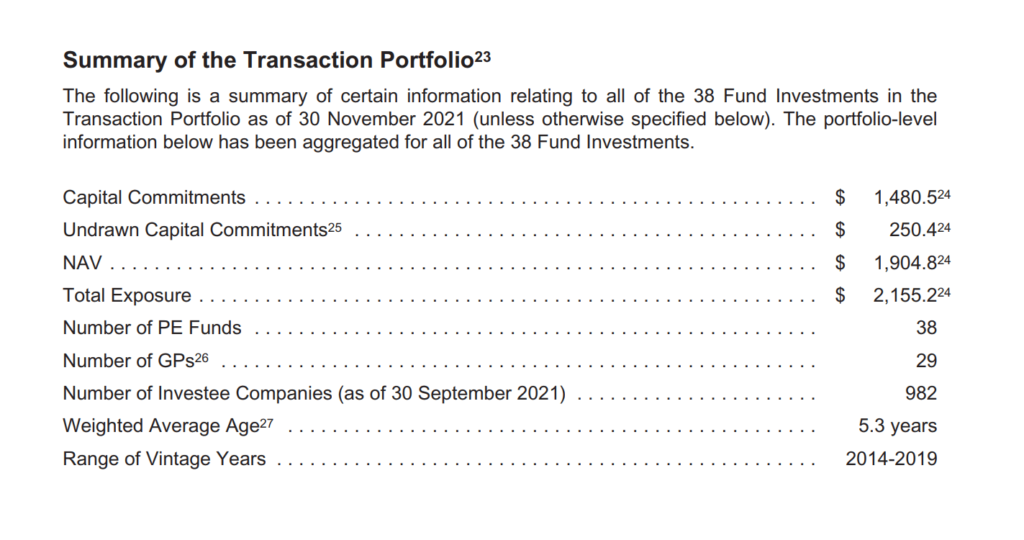

Assisted Living Facilities Nursing Convalescent Homes Nursing Homes-Skilled Nursing Facility. Class A-1 A-2 and B backed by cash flows from a US19 billion portfolio of investments in 38 Private Equity Funds Total issue size of US755m against a Transaction Portfolio NAV of US19bn. The indicative total size of the new issuance called Astrea 7 is US755 million.

8 hours agoBy My Sweet Retirement May 19 2022. Temasek-linked Astrea 7 is pricing three classes of private-equity bonds with public and institutional tranches according to a client note seen by Shenton Wire Wednesday. Fitch Ratings expects to rate the class A-1 A-2 and B bonds to be issued by Astrea 7 Pte.

Out of a total indicative size of USD 755m Class A-1 bonds will have an allocation of USD 380m SGD 526m while Class A-2 and B will have a. The proceeds will be used for refinancing of green assets according to its Green Financing Framework dated September 24 2020. Class A-1 A-2 and B backed by cash flows from a US19 billion portfolio of investments in 38 Private Equity Funds.

Astrea 7 is a private equity PE collateralized fund obligation CFO backed by interests in a diversified pool of alternative investment funds with approximately USD19 billion in net asset value NAV and. AZALEA Asset Management an indirect subsidiary of Temasek Holdings is launching a new series of bonds back by 38 private equity PE funds. Astrea 7 offers three classes of bonds.

See reviews photos directions phone numbers and more for Lesbian locations in East Rutherford NJ. Ltd a wholly-owned subsidiary of Azalea. Astrea is a series of bonds that are issued by a holding company that also held private equity funds as assets.

There will be two types of bonds available to retail investors. Similarly to the past launches there are three classes of bonds. There will be two types of bonds available to retail investors.

Similarly to the past launches there are three classes of bonds. Class A-1 Bonds of Astrea VI PE Bonds will pay investors 300 pa. Temaseks Azalea launches Astrea 7 PE-backed bonds.

Application will close on 25 May 2022 12pm. Application will close on 25 May 2022 12pm. This will be the 4th bond from Azalea with.

However we have to recognise that the current interest rate environment is lower than when Astrea IV and V were issued. Ad Learn why conservative investing might not be as safe and prudent as it sounds. Astrea is sponsored by Astrea Capital which is a wholly owned subsidiary of Azalea Asset Management which in turn is wholly owned by Singapore state-owned investment company.

In this issue of Astrea 7 the bonds is tied to 38 PE private equity funds. The companys File Number is listed as 0400374588. Interest rates to be decided AZALEA Asset Management an indirect subsidiary of Temasek Holdings is launching a new series of bonds back by 38 private equity PE funds.

The indicative total size of the new issuance called Astrea 7 is US755 million. Retail investors can also apply for Class B bonds which pay a higher fixed interest rate of 6 per cent per annum. Today Azalea Asset Management has released the Astrea 7 bonds for application.

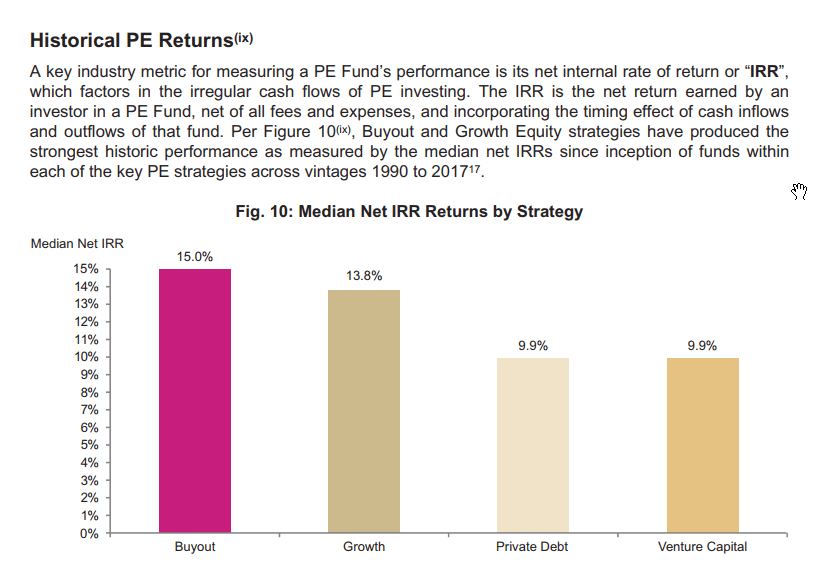

Class A-1 A-2 and B backed by cash flows from a US19 billion portfolio of investments in 38 Private Equity FundsOnly Class A-1 and B bonds are available for application. The bonds will rely on the cash flow from the underlying companies in the private equity funds to pay the interest coupon. But aside from that the term of the Astrea 5 is shorter than the Astrea 7 but the yield is also lower so we cannot really assess the quality difference between Astrea 5 and 7.

2 hours agoOn 19 May 2022 Azalea Investment Management launched its latest batch of Astrea private equity PE bonds for public subscriptions. Temaseks indirect subsidiary Azalea has launched an Astrea 7 bond backed by 38 Private Equity PE funds. New Jersey Division of Revenue.

Astrea 7 Pte. Astrea 7 or the issuer as seen in the table above. Most likely the Astrea 5 bonds will be called back in 1 to 2 years.

Astrea 7 marks the seventh series of asset-backed securities offered by the Group and the cash flows are backed by a portfolio of 38 private equity PE funds with over 982 investee companies. It also raised 650mn via a 4NC3 bond at a yield of 4131 15bp inside initial guidance of UKT280bp area. The bonds received orders over 3bn 6x issue size.

Retirees beware of this conventional wisdom. Today Azalea Asset Management has released the Astrea 7 bonds for application. Astrea 7 bond application begins today 20 may 22 at 9am.

The quantum is subject to change because Astrea 7s prospectus is preliminary. 12 hours agoToday Azalea Asset Management has released the Astrea 7 bonds for application. 17 hours agoThe public offer of Astrea 7 PE bonds comprises S280 million in Class A-1 bonds which pay a fixed interest rate of 4125 per cent per annum above the coupon for Class A-1 bonds in the previous Astrea V and VI issuances.

Class A-1 Bonds with a fixed interest rate of 4125 per annum and Class B Bonds with a fixed interest rate of 6 per annum. On May 19 2022 By My Sweet Retirement In Money Management. I noticed that the credit quality of Astrea 7 Class A-2 and B are lower than the Astrea 5 issue based on Fitch Rating.

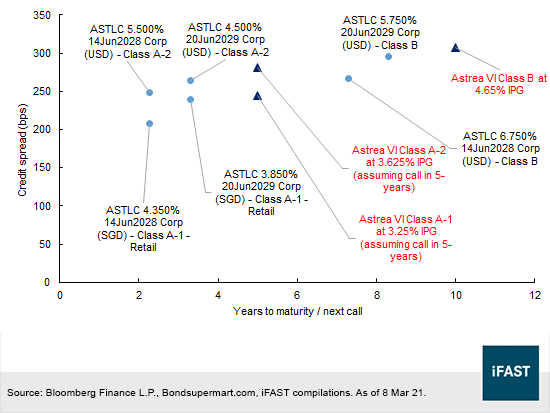

Azalea is an indirect wholly-owned subsidiary of Temasek Holdings Private Limited with the aim is to make private equity accessible to retail investors as it usually require a high amount of investment capital. When you compare this to when Astrea IV 435 and Astrea V 385 first offered its Class A-1 Bonds the interest is slightly lower. Temaseks Azalea launches Astrea 7 PE-backed bonds.

Astrea V 385 for Class A-1. Class A-1 A-2 and B backed by cash flows from a US19 billion portfolio of investments in 38 Private Equity Funds. Interest rates to be decided.

𝑅𝑒𝑖𝑛ℎ𝑎𝑟𝑑 𝑣𝑎𝑛 𝐴𝑒𝑠𝑡𝑟𝑒𝑎 Anime Anime Icons Art

Temasek S Azalea Launches Astrea 7 Pe Backed Bonds Interest Rates To Be Decided Banking Finance The Business Times

Temasek S Astrea Vi Lining Up New Usd And Sgd Pe Backed Bond Offering Track Live Bond Prices Online With Bondevalue App Temasek Holdings

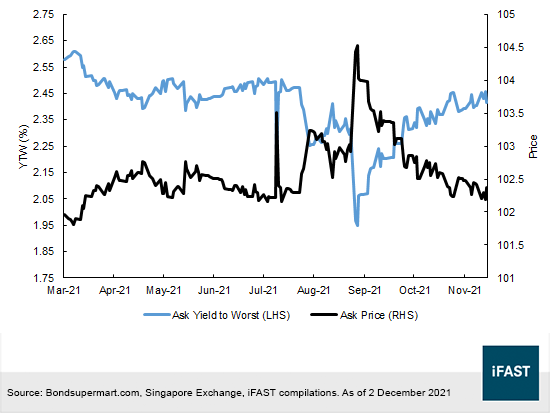

Astrea Pe Bonds Are Still Going Strong Amidst The Omicron Selloff Bondsupermart

Astrea Vi Private Equity Bond 10 Things To Know Before Investing

Azalea Launches Astrea 7 Pe Backed Bonds At Indicative 755mn Size

Temasek S Astrea V Targets Us 600 Million For Its Pe Bond Track Live Bond Prices Online With Bondevalue App

Astrea V Bond What Singaporeans Need To Know

Astrea Vi S Retail Tranche Of A 1 Launched At 3 Institutional Hni Tranches Placed Track Live Bond Prices Online With Bondevalue App Temasek Holdings Astrea Iv

Astrea Vi The Most Anticipated Pe Bond Offering For 2021 Has Been Announced Part 1 Bondsupermart